Apollo Global Management (APO)·Q4 2025 Earnings Summary

Apollo Beats on Record FRE, Hikes Dividend 10%, Touts Minimal Software Exposure

February 9, 2026 · by Fintool AI Agent

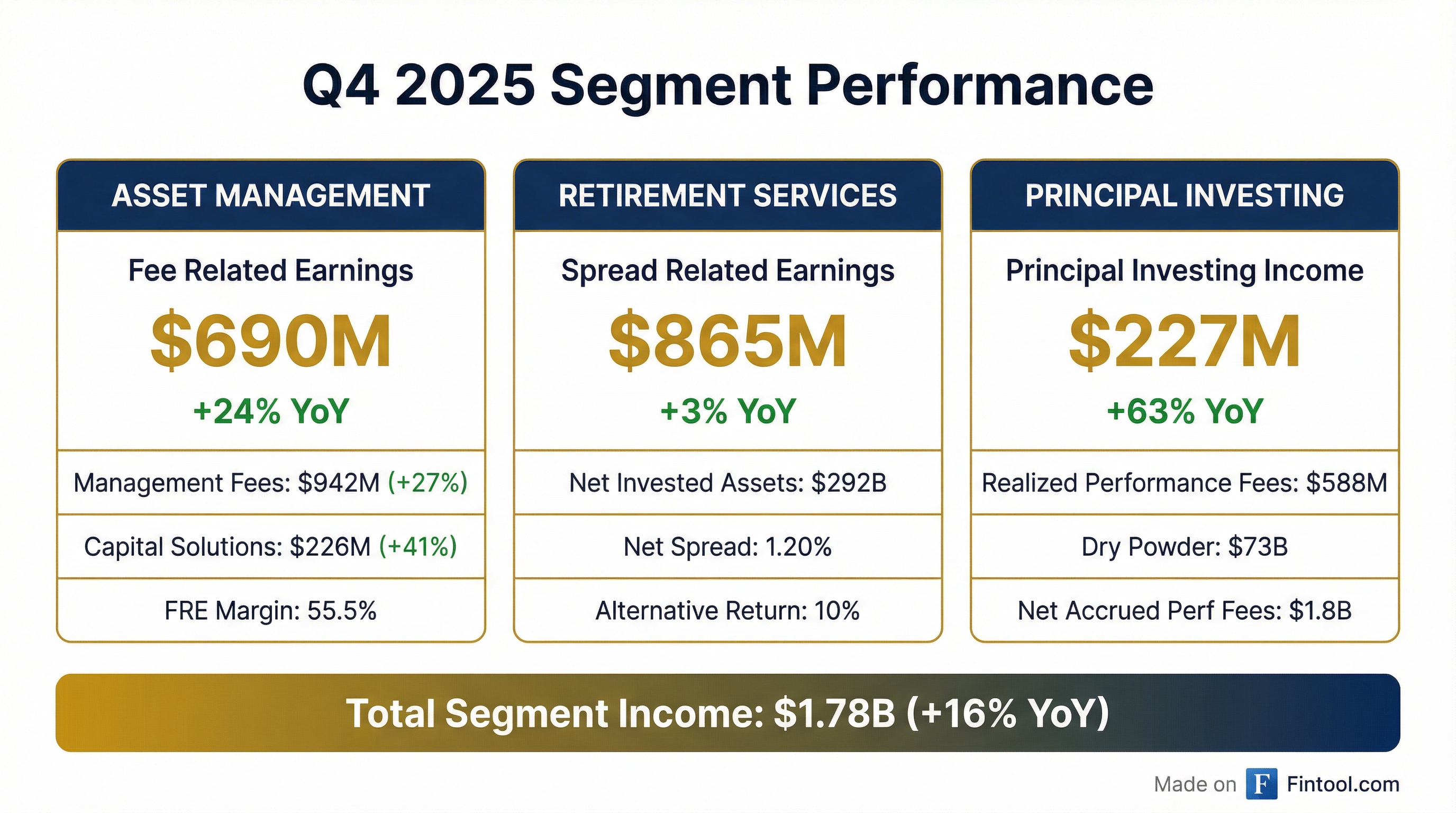

Apollo Global Management delivered a strong Q4 2025, beating consensus on its primary earnings metric by 30% while announcing a 10% dividend increase and a new $4B share repurchase program. The alternative asset manager reported Adjusted Net Income (ANI) of $2.47 per share versus the $1.90 consensus estimate, driven by record Fee Related Earnings (FRE) of $690 million and Principal Investing Income (PII) of $227 million .

CEO Marc Rowan highlighted 2025 as a year of "exceptional execution," pointing to record origination activity exceeding $300 billion and inflows of more than $225 billion .

Did Apollo Beat Earnings?

Apollo handily beat expectations across key metrics:

The beat was driven by:

- Record FRE of $690M (+24% YoY) on 27% management fee growth and 41% capital solutions fee growth

- Strong PII of $227M (+63% YoY) from realized performance fees of $588M in Q4

- Robust SRE of $865M supported by strong organic growth and 10% alternative investment returns

Why Is Apollo Emphasizing Software Exposure?

A key theme on the call: Apollo's minimal software exposure vs. peers. Given recent software sector volatility, management spent significant time positioning Apollo defensively :

CEO Marc Rowan's framing:

"Software is an amazing business. The market's overreaction to software is extreme. But clearly, factors have changed... If you were aggressive at a point in time when valuations were very high and not a lot of diligence was being done and people were expecting growth forever, you're playing defense now. I assure you, we are on offense."

President Jim Zelter's context:

"Software represented approximately 40% of all sponsor-backed private credit and 30% of all PE deployment for more than a decade... We see parallels between software and prior cycles where an influx of capital fuels overallocation, dispersion follows, and patience is rewarded."

Management's "principal's mindset vs. agent's mindset" distinction was clear: principals own assets for the long term and focus on risk-adjusted returns, while agents respond to hot markets and focus on what can be sold .

How Did the Stock React?

Apollo shares rallied +5.5% on the earnings release, closing at $133.03 with aftermarket trading pushing to $134.98 .

The stock remains 19% below its 52-week high of $164.76 despite the strong quarter. The positive reaction reflects:

- Significant earnings beat (+30% vs consensus)

- 10% dividend increase to $2.25/share annually

- New $4B share repurchase authorization (replacing prior $3B program)

- Record full-year metrics across multiple categories

What Changed From Last Quarter?

Key sequential changes from Q3 2025 to Q4 2025:

The dramatic surge in Principal Investing Income (+354% QoQ) was the key differentiator, driven by $588M in realized performance fees from Fund X, Accord+, and Credit Strategies that crystallize on an annual basis .

What's Driving Segment Performance?

Asset Management: FRE at Record Highs

Fee Related Earnings reached a record $690M in Q4 and $2.53B for full-year 2025 (+23% YoY) :

FRE margin compressed slightly to 55.5% (vs 58.0% in Q4 2024) due to continued investment in hiring and infrastructure, plus the full-quarter run-rate from the Bridge acquisition .

Retirement Services: Athene's Steady Engine

Spread Related Earnings of $865M (+3% YoY) reflected strong organic growth offset by higher financing costs :

- Net Invested Assets: $292B (+18% YoY)

- Net Investment Spread: 1.58% (excluding notable items)

- Alternative Return: 10% (vs 11% long-term target)

- Fixed Income Portfolio: 97% investment grade

Athene generated record organic inflows of $82B in 2025, with strong retail FIA/MYGA volumes and flow reinsurance activity .

Principal Investing: Carry Realizations Surge

Principal Investing Income surged to $227M (+63% YoY) driven by :

- Realized performance fees of $588M (vs $321M in Q4 2024)

- Strong crystallization from Fund X, Accord+, and Credit Strategies

- PII compensation ratio of 61% (within long-term target range)

Management noted realized performance fees were "cyclically light" for full-year 2025 as monetization from flagship PE and hybrid funds was "prudently delayed amid a dynamic exit environment" .

What Did Management Guide?

Apollo provided explicit 2026 guidance across multiple segments — notably confident for a year without a flagship fundraise:

Asset Management (FRE)

- 20%+ FRE growth expected in 2026

- 75% of revenue growth from core businesses (asset-backed finance, direct lending, multi-credit, hybrid)

- 25% from newer initiatives (Apollo Sports Capital, Athora's pending PIC acquisition)

- FRE margin expansion: ~100bps annually going forward

- Non-comp costs: low double-digit growth (includes full year of Bridge)

- Compensation costs: high-teens growth (build-out for six markets + Bridge)

Retirement Services (SRE)

- 10% SRE growth in 2026 (~$3.85B at 11% alts return)

- 10% average SRE growth reaffirmed through 2029

- Net spread: 120-125 bps expected

- Athene inflows: ~$85B expected (vs. $83B in 2025)

Capital Return

- Dividend: Increased 10% to $2.25/share annually (from $2.04)

- Dividend growth target: ~10% annually (~half FRE growth rate)

- Share repurchases: Immunize equity-based compensation

Principal Investing

- Long-term PII guidepost: $900M annually (not a straight line)

- Fund 10 already at 0.3+ DPI vs. industry at ~zero

What Are the Key Growth Drivers?

Apollo's three strategic growth pillars showed strong execution :

1. Origination: Record Activity

- Q4 2025: $97B (record quarterly)

- FY 2025: $309B (record annual)

- Driven by core credit and origination platforms

2. Global Wealth: Scaling Distribution

- Q4 2025 Inflows: $4B

- FY 2025 Inflows: $18B (record)

- Momentum in semi-liquid products and fixed income replacement strategies

3. Capital Solutions: Fee Diversification

- Q4 2025 Fees: $226M (record quarterly)

- FY 2025 Fees: $808M (record annual)

- Demonstrating "differentiated and flexible capital solutions at scale"

AUM and Flows: Continued Scale Building

Nearly 60% of total AUM and over 70% of Fee-Generating AUM is perpetual capital, providing stability and consistent growth .

Investment Performance Highlights

Net accrued performance fee receivable increased to $1.84B (from $1.81B in Q3), reflecting unrealized gains net of realizations .

Balance Sheet and Capital Position

Apollo maintains strong credit ratings: A2/A/A from Moody's, S&P, and Fitch .

What Is Apollo's Six Markets Strategy?

A recurring theme on the call: Apollo has expanded from serving one market (institutional alternative portfolios) to six markets, each with similar size potential :

CEO Rowan emphasized each market requires "different products, different product structures, different access points, different investments in technology" .

Key insight on 401(k): Management expects DOL guidance/rulemaking needed before large volumes, but sees guaranteed lifetime income as the ultimate hybrid solution between defined benefit and defined contribution .

Q&A Highlights: What Analysts Asked

On Non-Traded BDCs and ADS (Alex Blostein, Goldman Sachs)

Q: Is ADS's defensive positioning resonating with advisors given software turbulence?

Jim Zelter: "Yes... We had net new assets up every quarter last year, over $5 billion of net inflows... We expect to be picking up share. Investors are really seeing that rather than chasing the hot dot." Also emphasized: "Investors should diversify away from corporate exposure — that's why we're so excited about ABC, really the flagship vehicle in asset-backed portfolio construction."

On Total Portfolio Approach Adoption (Glenn Schorr, Evercore ISI)

Q: Are LPs rethinking allocation to privates or just structure?

Marc Rowan: "So much of the conversation has taken place around the alternative bucket. The vast majority of growth going forward is going to take place outside of the alternative bucket... Insurance is an institutional business. Debt and equity portfolios of institutions is an institutional business. 401(k), while we think retail is making a choice, is actually an institutional business made primarily by trustees and consultants."

On Competition at Athene (Ben Budish, Barclays)

Q: What's the state of retail channel competition?

Marc Rowan: "Most companies competing in this industry do not have origination of appropriate assets, do not have a low-cost liability factory, and do not produce at an efficient level. The only way return can be achieved is by giving away asset management fees and by moving the business offshore to Cayman... This is not a recipe for success. Athene is a really tough competitor."

On Being "On Offense" in Software (John Barnidge, Piper Sandler)

Q: Where in software do you find opportunities — PE, credit, or both?

Jim Zelter: "You had companies in this sector priced or purchased at 15x revenue several years ago, maybe even 20x revenue. And now they're trading at 12-16x earnings... There's a very large difference in that valuation gap. We're going to be much more on the offense. But there's nothing happening tomorrow... This is dispersion over time."

ARI Transaction: What's the Strategy?

Apollo announced acquisition of $9B commercial mortgage assets from Apollo Commercial Real Estate Finance (ARI), subject to stockholder approval :

- Spread premium: 50-75 bps vs. new issued CMLs

- Portfolio familiarity: Athene already has ~50% ownership overlap with underlying loans

- Conservative LTVs: Attractive yields with risk-managed positioning

Strategic rationale (Marc Rowan): "Institutions are looking really hard for durable spread, safe yield. Individuals trade these vehicles at a discount. The notion of us continuing to invest into vehicles that don't create value to shareholders didn't make a lot of sense. Best outcome: transfer portfolio at fair market value from public company trading at discount to NAV to Athene."

The transaction "helps de-risk" 10% SRE growth target but isn't additive to it — it displaces other SRE lending .

What Should Investors Watch?

Positive Catalysts:

- Software dislocation opportunity: Management explicitly "on offense" — expect Apollo to be a capital provider as valuations reset

- Origination globalization: $245B North America, $40B Europe, $15-20B Asia in 2025 — taking strategy global

- Ecosystem strategies: Apollo Sports Capital expected to generate $30-50B of origination opportunities

- Public market volatility: "If anything's going to speed [total portfolio adoption] up, it'll be volatility"

- 401(k) rulemaking: DOL guidance could unlock significant DC market volumes

Risks to Monitor:

- Net spread compression at Athene (1.20% vs 1.21% QoQ)

- FRE margin pressure from high-teens comp growth (building for six markets)

- Alternative investment returns below long-term 11% target (Q4: ~10%)

- PRT volume uncertainty despite improving legal situation

- Exit environment still "dynamic" — PII timing unpredictable

Full Year 2025 Summary

Management Tone: "Playing to Win"

Apollo held its partner summit in Tokyo last week with 200 partners, themed "playing to win" . Key tone shifts:

On defensive positioning:

"At Athene, while others have reached for spread, we have been positioned defensively. We've built $24 billion position of cash treasuries and agencies. While this is a short-term drag, we are always willing to sacrifice short-term profitability for doing the right thing." — Marc Rowan

On competitive moat:

"At scale, investing does not get simpler. It gets more complex. What differentiates Apollo is that we built a system designed to absorb that complexity and convert it into consistent, high-quality outcomes for our clients. That is our long-term moat." — Jim Zelter

On growth philosophy:

"Let's look through the windshield, not through the rearview mirror. We have so much white space in front of us. It's up to us to now prepare the business, not just to hit the five-year plan but for what comes next." — Marc Rowan